RIGHTS OF MINORITY SHAREHOLDERS ARE SHOWCASED

14.03.2019 / The law recognizes these rights, but restricts their exercise

Not everyone knows what it is like to be a property owner. To be precise, small shareholders are citizens who overcame artificial obstacles created by the Auction Center to become shareholders in various institutions in exchange for state privatization cheques. First of all, because the majority of joint stock societies in the country do not operate transparently, they keep financial reports hidden from shareholders and do not pay dividends. Moreover, changes in the legislation have become a further obstacle for small shareholders.

The amendments started in April 2018. These amendments were made to the Civil Code (http://e-qanun.az/framework/38636) laying out new legal norms on the responsibilities of persons represented in management of legal entities. These amendments define the circle of persons with the right to demand compensation and liability for damages inflicted by the Supervisory Board and the executive body of a company. Until then, any shareholder could demand compensation, regardless of the amount of stakes and shares they held. The aforementioned amendments restricted this right to those holding a minimum 5% share. A law adopted on 28 December of that same year further limited the rights of small shareholders in the management of companies.

Azerbaijan-style controversy: 100000 shareholders, 5-10 owners

In Azerbaijan companies are usually established as limited liability (LLC) or joint-stock (JSC). LLC shareholders average about 1-3 people. Shareholders of newly established JSCs are usually a small number of partners with established businesses based on mutual confidence. Thus, the new norm of the Civil Code we will be talking about is more relevant to open joint-stock companies (OJSC), which are established on the basis of state institutions and then privatized, along with some commercial banks and insurance companies.

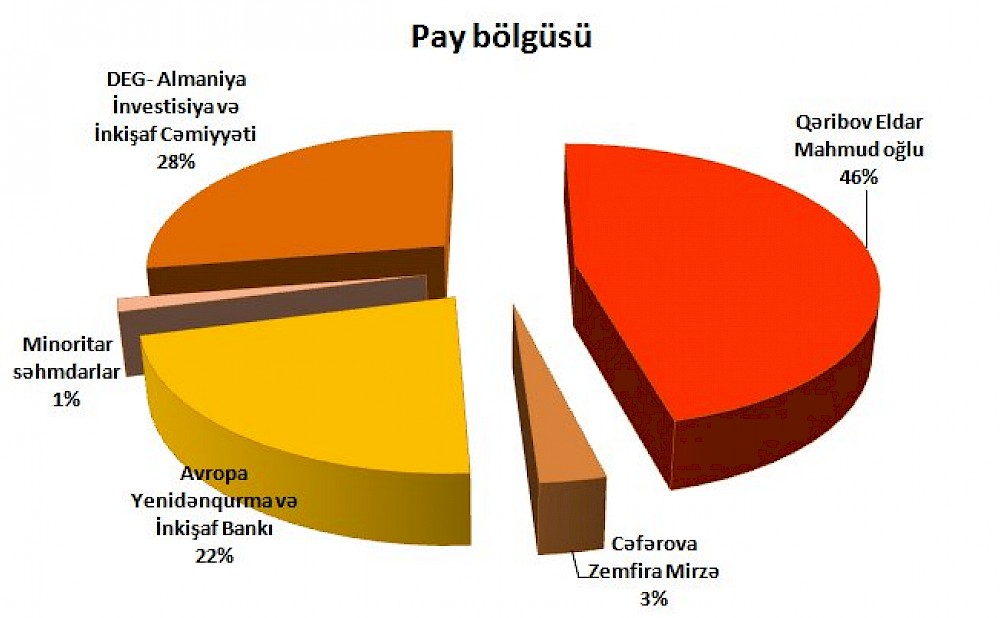

There are up to 1700 companies established in the process of privatization of state property in Azerbaijan, with the majority having over 100 shareholders. The State Committee on Property Issues states that more than 100,000 citizens became shareholders during the privatization process. But the shares are equally divided among shareholders in only some of the organizations with a high number of shareholders..

The privatization of shares of joint stock companies proceeded as follows: 30% of shares were sold in money auctions, in specialized cheques, and specialized money auctions. In the following stage, 55% of shares were sold in total, with 15% going to members of labour collectives. But in practice, the result is mostly similar: the labour collectives got up to 3% of total shares, and the rest of shares were sold in cheque auctions. These cheque auctions took place in a non-transparent atmosphere and were falsified in favour of previously agreed upon persons. Ultimately, almost all shares in each company would be purchased by a single buyer. This is the stark reality of this massive privatization effort, which was completed in 2010. According to expert evaluations, in 95% of these JSCs, more than 90% of shares belong to just one or two persons. If we count up all the shares of remaining shareholders, it does not even total 10%. In more than 50 JSCs that were privatized through investment competition, the situation is similar: 97-99% of shares were sold to the same investor. The process continues in the same manner to this day; furthermore, legislative changes were created in this corrupt and opaque atmosphere.

“Prove that I have inflicted damages on you”

Until April 2018, the management of a company were legally and financially liable for damages to legal entities and shareholders (stakeholders); however, the law did not define the grounds for determining damages. As a result, when shareholders would find out about damages in financial reports, they would have a hard time fighting company managers in court. Article 49.4, added to the Civil Code in April 2018, empowers a representative of a legal entity to determine the grounds of damages inflicted on a shareholder (it is interesting that majority of such cases are characteristic for Azerbaijan, but there is no information regarding prominent cases, which have caused public outcry, related to liability for inflicting damages).

According to the law, a shareholder is legally allowed to demand damages being paid when property is being privatized or used under significantly worse conditions or depressed market value.

When shares turn into worthless pieces of paper...

The shareholder Vazir Rajabov states that the property and land of the Ushaq Sevinci OJSC was sold for well below its market value. This fact was confirmed by an evaluation of experts involved in the court proceedings. The property was valued at 11 mil AZN, but was sold for just 50,000 AZN by the executive body of the JSC to the main shareholder of the JSC: Nurgun Motors LLC. Along with that, managers of this JSC did not sell the property in an open auction, in contravention of market rules. As a result, the securities of V. Rajabov and other small shareholders like him turned into worthless pieces of paper, since their securities were no longer backed by anything. V. Rajabov and other minority shareholders appealed to the court, but they were ultimately unsuccessful in securing compensation or to even have anyone held liable.

According to the law, signing contracts with persons linked to a legal entity that is found to have violated the law or caused a threat to the interests of a legal entity would be held liable. But in practice, this is rarely enforced effectively. For example, Quba Konserv-2 OJSC’s 20 large juice containers are used by Gilan LLC. Gilan LLC owns 94% of shares of the Guba can factory, which means that Gilan LLC is linked to Quba Konserv-2 OJSC. The Chief Director of the company gave this property to Gilan LLC for free and for an unlimited period. One of the minority shareholders protested this and sent a letter to the general meeting of the JSC, which took place in the summer of the previous year, where he requested payment for damages and for the director to assume liability. The letter was left unanswered.

The Civil Code has established other forms of damages to a legal entity or a shareholder (stakeholder). These include:

- payment of bonuses to members of management of a legal entity at a level disproportionate to the profits of said legal entity, or when said legal entity is losing money;

- purchase of products (services) for a price significantly higher than their true market value, based on contracts signed with legal entities;

- misappropriation or squandering of property of a legal entity for the purpose of ensuring material and/or non-material property benefits and ensuring rights to these property for personal use, for use by people relevant to the legal entity or other persons;

- signing of agreements found to be unjust or damaging to shareholders (stakeholders).

The parliamentary lobby of large shareholders

If a shareholder wants to bring a complaint for damages,, first of all, he/she needs to prove whether damages have occurred at all. When circumstances envisaged by Article 49.4 of the Civil Code do occur, or when there is substantiated suspicion in connection with these, then all relevant documents can be demanded. However, even if you have the documents, the right to complain is restricted and not all shareholders can do so. As mentioned above, until December 2018, this right was only granted to shareholders with at least a 5% stake in the statute capital of a company. Later that year, large shareholders were able to push through the adoption of a law that was in line with their interests. According to amendments to the Code (http://e-qanun.az/framework/41152), in order to obtain documents proving the infliction of damages, the shareholder now must have at least 10% of shares, instead of the previous 5%. In corporative share relations of Azerbaijan, this means that the law is effectively unenforceable

It is interesting to note that the latest change to the Code led to a certain controversy with the previous relations system. Article 49.3 of the Civil Code shows that when the representative of a legal entity violates his/her duties, he/she should pay for damages inflicted on shareholders holding at least 5% of shares in statute capital. But as mentioned above, the fact of violation must be proven. However, 5% of shares is no longer considered sufficient to secure those documents.